5G Monetization in Asia

The telecommunications landscape across Asia is experiencing a fundamental transformation as operators navigate the transition from 5G infrastructure deployment to sustainable revenue generation. With the Asia Pacific region projected to exceed $130 billion in 5G-related revenues by 2030, telcos are under unprecedented pressure to demonstrate tangible returns on their substantial infrastructure investments. This shift marks a critical juncture where technical capabilities must translate into profitable business models that justify the estimated $600 billion in global 5G investments between 2022 and 2025.

The Monetization Imperative

Asian telecom operators find themselves at a crossroads between aggressive 5G deployment and profitability. The APAC 5G market has reached a maturation point where capital expenditure is stabilizing as operators achieve significant coverage milestones. This development, reflected in the 39% year-on-year revenue decline for equipment vendors like Ericsson across Southeast Asia, Oceania, and India in 2024, signals a strategic pivot from network construction to revenue optimization.

The monetization challenge is particularly acute in markets like India, where intense price competition and commoditization of traditional voice and data services have compressed margins. Operators must now leverage advanced 5G capabilities including network slicing, edge computing, and ultra-reliable low-latency communications to unlock new revenue streams and justify continued investment.

Consumer-Driven Revenue Streams

Despite early skepticism about consumer willingness to pay premium prices for 5G services, the GSMA Intelligence Consumers in Focus Survey 2025 reveals strong demand and payment willingness for enhanced mobile broadband services. This consumer enthusiasm has enabled several innovative monetization strategies across the region.

5G Bundling and Service Integration

Singapore’s Singtel exemplifies the bundling approach by offering free subscriptions to services like Bookful and MelodyVR for 5G customers on higher-tier plans. Similarly, Australia’s Optus includes streaming service subscriptions such as Netflix for 5G home broadband customers, creating value propositions that extend beyond connectivity.

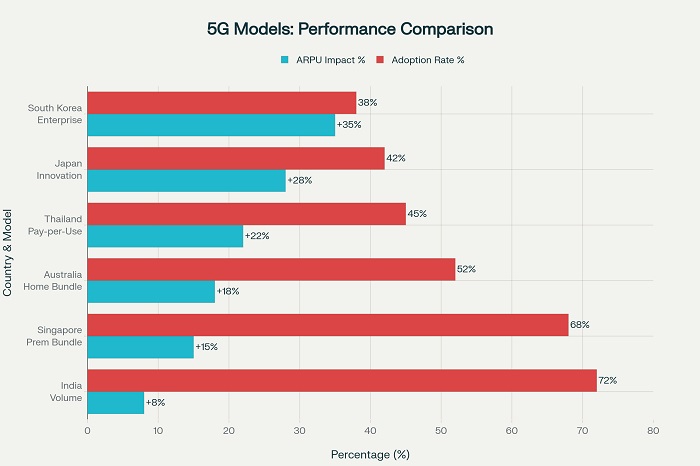

Thailand’s AIS has demonstrated the effectiveness of experience-driven pricing through its 5G Mode add-on service, launched in December 2023. This pay-as-you-need solution allows customers to access premium connectivity for specific activities like live content creation and gaming sessions. By February 2025, the service reached 180,000 users, with each purchase increasing monthly revenue per customer by approximately 22%.

Premium Experience Offerings

The consumer segment increasingly values differentiated experiences over raw bandwidth. Singtel’s extension of network slicing capabilities to consumers through its ‘5G+’ service represents a sophisticated approach to premium monetization. Previously reserved for enterprise customers, these capabilities enable tailored connectivity experiences that command higher pricing.

Enterprise Market Expansion

The enterprise segment presents the most significant monetization opportunity for 5G networks across Asia. A GSMA Intelligence survey found that 16% of operators in the Asia Pacific expect private networks to contribute over 20% of their enterprise revenues through 2025. This represents a substantial shift from traditional enterprise connectivity models toward specialized, high-value service delivery.

Private 5G Networks

Private 5G deployment has gained tremendous momentum across highly digitalized markets including Australia, Japan, South Korea, and Singapore. The Asia Pacific private 5G network market, valued at $587.6 million in 2023, is projected to reach $12,007.2 million by 2030, representing a compound annual growth rate of 53.9%.

Manufacturing, logistics, and healthcare sectors are driving adoption through use cases that require guaranteed performance, enhanced security, and operational efficiency. Industry 4.0 initiatives across the region create substantial demand for dedicated connectivity solutions that can support automation, real-time analytics, and critical communications.

Vertical Industry Solutions

Chinese operators have achieved notable success in vertical applications, with an estimated 76% of telcos witnessing year-over-year growth in overall enterprise revenue during the first half of 2024. China Mobile’s development of integrated 5G-based cloud-network-terminal systems for unmanned aerial vehicles demonstrates how operators can leverage their native network assets to create industry-specific solutions.

The key to successful vertical application deployment lies in contextual optimization and leveraging operator-specific network characteristics. This approach enables telcos to create solutions that competitors cannot easily replicate while addressing genuine industry needs.

Technology Convergence and New Services

Edge Computing Integration

The convergence of 5G and edge computing creates new monetization opportunities by enabling ultra-low latency applications and localized data processing. Telecom operators are positioned to capitalize on edge computing demand by offering compute resources at network edges, supporting applications like autonomous vehicles, industrial automation, and smart city services.

This infrastructure convergence allows operators to move beyond connectivity provision toward comprehensive technology platform services. Edge computing capabilities enable new business models including Infrastructure-as-a-Service offerings tailored to enterprise requirements.

Network APIs and Programmable Networks

Telstra and Ericsson’s collaboration on Asia-Pacific’s first programmable 5G network demonstrates the monetization potential of network APIs. These Application Programming Interfaces allow third-party developers to create applications and services that leverage network capabilities, opening new revenue streams through platform business models.

The adoption of network APIs aligns with global initiatives like Aduna, which supports API-driven service development. This approach enables operators to participate in broader digital ecosystems while generating revenue from network capabilities previously unavailable to external developers.

Regional Market Dynamics

Leading Markets

Singapore, Malaysia, and Thailand lead regional 5G rollouts and monetization efforts, while countries like Myanmar, Laos, and Timor-Leste still face rural connectivity challenges. This disparity creates opportunities for infrastructure sharing and gradual market development approaches.

South Korea and Japan have established strong 5G foundations that support advanced monetization strategies. These markets serve as testing grounds for technologies and business models that can be adapted across the region.

Emerging Opportunities

Vietnam’s rapid 5G adoption, with Viettel and VNPT reporting over 5 million and 3 million connections respectively by early 2025, demonstrates the potential for aggressive monetization in emerging markets. The country’s decision to phase out 2G by 2026 creates opportunities for comprehensive network modernization and advanced service deployment.

India’s massive market potential continues to attract investment despite price competition challenges. The scale of the Indian market enables operators to achieve profitability through volume-based strategies while gradually introducing premium services.

Strategic Implementation Framework

Successful 5G monetization in Asia requires a multi-faceted approach combining consumer and enterprise strategies. Operators must identify high-impact industry verticals while developing tailored deployment models that demonstrate clear return on investment. This includes offering integrated solutions combining connectivity, edge computing, and cloud-based platforms.

Building ecosystem partnerships expands service offerings beyond core network capabilities. Collaborations with technology providers, system integrators, and industry specialists enable comprehensive solution delivery that addresses complete customer requirements.

The transition from network deployment to revenue generation represents the next phase of 5G evolution across Asia. Operators that successfully navigate this transition through innovative service development, strategic partnerships, and customer-centric solutions will establish sustainable competitive advantages in the expanding digital economy. The substantial market opportunity, projected growth rates, and demonstrated consumer willingness to pay for enhanced services create a favorable environment for operators committed to monetization excellence.

The path forward requires continuous innovation, customer engagement, and strategic execution as the industry moves from infrastructure investment to sustainable profitability. Success in 5G monetization in Asia will determine operator viability and market leadership for the next decade of telecommunications evolution.