Telecom Investment and M&A in Asia

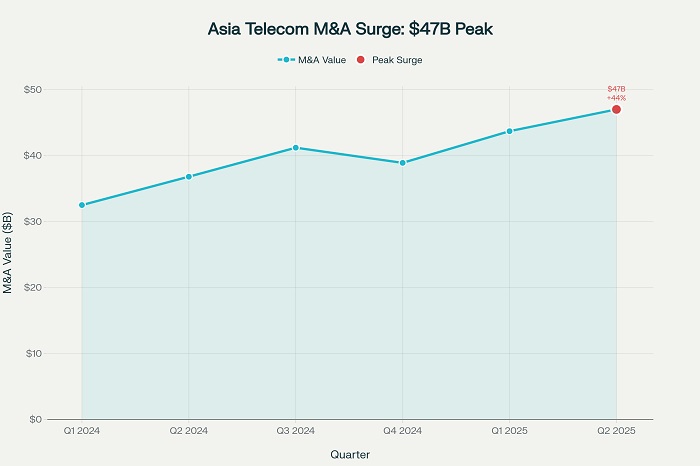

The Asia-Pacific telecommunications sector is experiencing unprecedented merger and acquisition activity as operators pursue strategic consolidation to enhance competitiveness, optimize costs, and prepare for next-generation technology deployment. With global telecom M&A value surging to $47 billion in the second quarter of 2025 and the first half total reaching $63 billion—representing a 44% increase over the same period in 2024—the industry demonstrates remarkable momentum in strategic repositioning. This consolidation wave reflects fundamental shifts in market dynamics, regulatory frameworks, and competitive pressures that are reshaping the telecommunications landscape across Asia.

Market Consolidation Drivers

Financial and Operational Pressures

Telecommunications operators across Asia face mounting financial pressures from hefty capital investments in 5G infrastructure, fiber deployment, and digital transformation initiatives. These substantial expenditures, coupled with rising interest rates and increased cost of capital, create challenging operational environments that drive consolidation as a strategic response.

The S&P Global analysis indicates that operators pursue mergers to achieve cost savings while redirecting capital toward debt reduction and new technology investments. This approach enables smaller operators to compete more effectively with market leaders while achieving operational efficiencies through scale and resource optimization.

Technology Investment Requirements

The transition to 5G networks requires massive capital expenditure that many operators struggle to finance independently. Mobile telecom operators are projected to spend over $600 billion on capital expenditure between 2022-25 for 5G rollout and network expansion, with Asia-Pacific representing a significant portion of this investment.

Tower infrastructure, fiber optic deployment, and data center development create substantial funding requirements that consolidation helps address. Asset-light strategies including tower divestments and infrastructure sharing enable operators to optimize balance sheets while maintaining network coverage and service quality.

Regional M&A Activity Analysis

Completed Major Transactions

Asia-Pacific has witnessed significant consolidation activity with five notable mergers since 2021 demonstrating successful value creation strategies. These transactions illustrate how strategic combinations can drive revenue growth, cost reduction, and operational improvements when executed effectively.

True and Dtac’s merger in Thailand, completed in March 2023, created a duopoly structure that enables the combined entity to return to profitability one year ahead of schedule. This accelerated timeline demonstrates the potential for well-executed mergers to generate substantial synergies and financial improvements.

Market Concentration Impacts

Thailand’s telecommunications market transformation into a duopoly through the True-Dtac merger raises competitive concerns while demonstrating consolidation benefits. With the combined entity controlling 53% market share alongside Advanced Info Service’s 45% share, the market exhibits characteristics that may influence pricing and service innovation.

Taiwan’s pending merger proposals could reduce the market from five operators to three major players, demonstrating continued consolidation momentum across the region. Regulatory approval processes reflect careful balancing of competitive concerns against efficiency benefits and investment capacity improvements.

Investment Patterns and Strategies

Infrastructure Development Focus

Telecommunications infrastructure investment in Asia encompasses towers, fiber networks, and data centers that support the region’s digital transformation. This infrastructure development requires substantial capital while creating opportunities for specialized investment and operational expertise.

Tower companies like EDOTCO operate across nine countries serving nearly 700 million people, demonstrating the scale and opportunity in telecommunications infrastructure investment. The company’s portfolio exceeding 58,000 towers with a 1.6x colocation ratio illustrates successful infrastructure monetization strategies.

Private Equity Participation

Private equity involvement in Asian telecommunications has fluctuated significantly, with the share of financial buyers growing from 60% in 2021 to over 80% in the first half of 2024. This increased financial buyer participation reflects attractive returns and stable cash flow characteristics of telecommunications infrastructure assets.

Infrastructure funds and private equity investors particularly target tower assets, with 97% of cell towers in the United States and Mexico now owned by entities other than original telco operators. This trend is expanding across Asia as operators pursue asset-light strategies and financial optimization.

Technology-Driven Investment Themes

5G and Advanced Network Technologies

5G deployment drives substantial investment requirements while creating opportunities for infrastructure sharing and optimization. The technology’s short-range characteristics necessitate denser network deployment that increases capital requirements while supporting new service categories and revenue streams.

Open RAN technology adoption creates investment opportunities in flexible, vendor-agnostic network architectures. This technology trend supports supply chain diversification while enabling cost optimization through increased vendor competition and standardized interfaces.

Edge Computing and Cloud Integration

Edge computing investment accelerates as operators recognize the strategic importance of distributed computing capabilities. These investments position telecommunications operators to participate in the growing cloud services market while supporting 5G monetization strategies.

The convergence of telecommunications and cloud technologies creates investment opportunities in hybrid infrastructure that combines connectivity and computing capabilities. This integration enables new service offerings while optimizing resource utilization across traditional industry boundaries.

Regulatory Environment and Policy Impact

Government Support and Strategic Direction

Government policies across Asia increasingly support telecommunications infrastructure development through spectrum allocation, regulatory streamlining, and strategic investment programs. The U.S. government’s support for Open RAN development in the Philippines demonstrates international cooperation in infrastructure modernization.

National digital infrastructure strategies influence investment patterns while creating opportunities for public-private partnerships. These initiatives accelerate deployment while providing regulatory clarity that supports long-term investment planning and strategic positioning.

Competition Policy Considerations

Regulatory authorities balance consolidation benefits against competitive concerns through careful merger review processes. The Herfindahl-Hirschman Index guidelines used to assess market concentration provide frameworks for evaluating merger impacts on competition and consumer welfare.

Cross-border investment policies influence strategic options while affecting competitive dynamics across regional markets. These regulatory considerations shape investment strategies and partnership structures while influencing market development trajectories.

Financial Performance and Value Creation

Successful Integration Examples

Indosat Ooredoo and Hutchison 3’s merger demonstrates successful value creation through strategic consolidation. The combined entity achieved 16% revenue growth and 22% EBITDA improvement in the year following merger completion, illustrating effective integration execution.

Celcom and Digi’s merger achieved modest growth while neutralizing integration risks and delivering 1% revenue improvement and 3% EBITDA growth during 2023. This performance demonstrates how careful merger execution can create value while managing operational complexity.

Synergy Realization Strategies

Successful telecommunications mergers require comprehensive integration planning that addresses network consolidation, operational efficiency, and commercial synergies. Taiwan Mobile and T-Star’s integration progress shows how systematic approach to network consolidation can accelerate synergy realization.

Integration momentum becomes critical for realizing merger benefits as operational delays can undermine value creation potential. FarEasTone and Asia Pacific Telecom’s early integration progress demonstrates how sustained execution focus supports synergy achievement and competitive positioning.

Future Investment Outlook

Market Structure Evolution

Continued consolidation will reshape market structures across Asia as operators pursue scale advantages and operational efficiency. Indonesia and Malaysia remain fragmented markets with opportunities for further consolidation, while other markets approach optimal competitive structures.

The evolution toward fewer, stronger operators creates opportunities for enhanced investment in network infrastructure and service innovation. This market structure development supports sustainable competition while enabling efficient resource allocation and technology advancement.

Emerging Technology Investment

6G development will drive new investment requirements while creating opportunities for strategic positioning in next-generation technologies. Early investment in 6G research, standardization participation, and infrastructure preparation will influence competitive outcomes in the next decade.

Artificial intelligence integration across telecommunications operations creates investment opportunities in network optimization, customer service enhancement, and operational automation. These technology investments support current operations while preparing for future competitive requirements.

Strategic Implications for Market Participants

Operator Strategies

Telecommunications operators must balance current operational requirements with strategic positioning for future technology transitions. This balance requires careful capital allocation while maintaining competitive strength in existing markets and emerging service categories.

Scale advantages through merger and acquisition enable operators to optimize investment efficiency while enhancing competitive positioning. Successful strategies combine organic growth with strategic transactions that create sustainable competitive advantages.

Investor Considerations

Infrastructure investment in Asian telecommunications offers attractive risk-adjusted returns through stable cash flows and growth opportunities. The sector’s essential nature and continued demand growth create favorable investment conditions despite periodic market volatility.

Technology transition periods create both risks and opportunities for investors as operational requirements evolve. Understanding technology trends and competitive dynamics becomes essential for successful investment timing and portfolio optimization.

The telecommunications investment and M&A landscape in Asia reflects fundamental industry transformation driven by technology evolution, competitive pressures, and regulatory changes. Success requires strategic vision, operational excellence, and financial discipline as operators navigate consolidation opportunities while positioning for future growth. Market participants that effectively balance current performance with strategic positioning will thrive in the evolving telecommunications ecosystem while those that fail to adapt risk competitive disadvantage in rapidly changing markets.