The Rise of Super Apps in Asia

The telecommunications industry worldwide is witnessing a paradigm shift as Asian super apps demonstrate the transformative potential of integrated digital platforms that transcend traditional connectivity services. These comprehensive applications, which combine social networking, payments, commerce, and lifestyle services within single interfaces, have achieved remarkable success in driving customer engagement, increasing average revenue per user, and creating sustainable competitive advantages. With the Asia-Pacific super apps market generating $35,957.8 million in revenue in 2023 and projected to reach $218,434.5 million by 2030 at a compound annual growth rate of 29.4%, global telecommunications operators have compelling evidence for the strategic value of super app development.

The Super App Phenomenon

Super apps represent all-in-one digital platforms that provide users with diverse services ranging from basic communication to financial transactions, e-commerce, and lifestyle offerings. These platforms achieve massive user engagement by consolidating multiple service categories within single applications, creating significant barriers to user switching while generating multiple revenue streams.

The super app market, valued at $61.30 billion in 2022, is projected to grow at a compound annual growth rate of 27.8% from 2023 to 2030, driven by increasing smartphone penetration and widespread adoption of digital services. Asia-Pacific leads this growth, accounting for over 46.8% of global market share in 2024, demonstrating the region’s leadership in integrated digital service delivery.

Regional Market Leadership

Asia-Pacific Dominance

The Asia-Pacific region dominates the global super apps market through platforms including WeChat, Alipay, and Grab, which offer comprehensive service portfolios spanning social networking and digital payments. These applications achieve remarkable scale with WeChat and Alipay each serving over one billion active users while creating integrated digital ecosystems.

Regional success factors include 95% smartphone adoption compared to the global average of 78%, creating extensive accessibility for super app services. Digital payment users in Asia-Pacific exceed 1.8 billion, representing 75% of global users, with UPI in India and Alipay/WeChat Pay in China driving adoption through seamless integration with super app platforms.

Cultural and Market Conditions

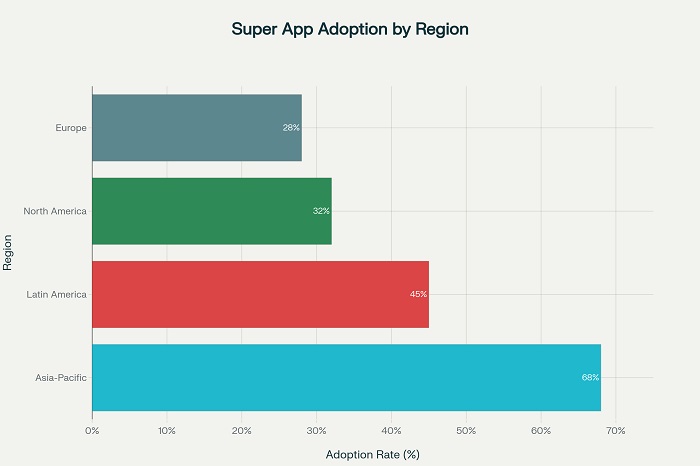

Asian markets demonstrate cultural preferences for all-in-one applications that contrast with fragmented service usage patterns in Western markets. This preference enables super apps to achieve 68% adoption rates among internet users in Asia-Pacific compared to 32% in North America, highlighting the importance of localized service integration.

Mobile-first digitalization strategies across Asia-Pacific create favorable conditions for super app development as smartphone adoption and internet penetration occur simultaneously. This concurrent development enables super apps to shape consumer behavior while filling gaps in physical infrastructure including banking and logistics networks.

Successful Super App Models

WeChat and Comprehensive Integration

WeChat exemplifies successful super app development through its evolution from communications platform to comprehensive digital ecosystem. The application expanded its reach through Mini Programs that embed third-party applications within the WeChat environment, enabling extensive service integration without user friction.

This platform approach demonstrates how telecommunications companies can leverage core communication services as foundations for broader digital service portfolios. WeChat’s success illustrates the potential for operators to become digital ecosystem orchestrators rather than simple connectivity providers.

Southeast Asian Innovation

Grab’s development across Southeast Asia demonstrates super app adaptation to regional market conditions and infrastructure gaps. The platform addressed transportation, delivery, and financial service needs while leveraging local partnerships to expand service offerings and market reach.

Gojek’s evolution in Indonesia shows how super apps can support financial inclusion while addressing diverse consumer needs through integrated service delivery. These platforms demonstrate the potential for telecommunications operators to participate in broader economic development while generating sustainable revenue growth.

Telecommunications Integration Opportunities

Revenue Stream Diversification

Super apps enable telecommunications operators to diversify revenue streams beyond traditional voice and data services through integrated payment systems, commerce platforms, and value-added services. This diversification creates more stable revenue profiles while increasing customer lifetime value through expanded service engagement.

Telcos can leverage their customer access and payment infrastructure to create super apps that increase revenue streams while enhancing user engagement. This approach positions operators at the center of customers’ digital lives while creating significant switching barriers through service integration.

Customer Relationship Enhancement

Super app development enables telecommunications operators to deepen customer relationships through comprehensive service delivery that extends beyond basic connectivity. This enhanced engagement creates opportunities for cross-selling and up-selling while improving customer retention through increased platform dependency.

The convenience and integration provided by super apps drive customer loyalty while creating competitive advantages that are difficult for competitors to replicate. Telecommunications operators can leverage their trusted relationships and infrastructure advantages to create compelling super app offerings.

Technology and Infrastructure Advantages

Network and Data Advantages

Telecommunications operators possess unique advantages for super app development through their network infrastructure, customer data, and payment processing capabilities. These assets enable operators to create differentiated super app experiences while leveraging existing operational capabilities.

Network control enables operators to optimize super app performance while providing quality of service guarantees that third-party platforms cannot match. This technical advantage creates competitive differentiation while supporting superior user experiences.

5G and Edge Computing Integration

5G network capabilities enhance super app functionality through improved performance, reduced latency, and enhanced connectivity that supports advanced applications. Edge computing integration enables real-time processing that improves super app responsiveness while reducing bandwidth requirements.

These technological advantages enable telecommunications operators to create super app experiences that leverage their unique network capabilities. Advanced connectivity features become competitive differentiators that support premium service offerings and enhanced user engagement.

Business Model Innovation

Platform Economics

Super apps benefit from network effects where increased user participation enhances value for all platform participants. Telecommunications operators can leverage these dynamics to create sustainable competitive advantages while generating revenue through transaction facilitation and platform usage.

Platform business models enable operators to capture value from ecosystem activity while supporting partner success and customer satisfaction. This approach creates scalable revenue generation opportunities that extend beyond traditional telecommunications services.

Fintech Integration

Financial service integration represents a critical component of successful super apps, with 80% of Asian super apps offering lending services compared to 55% in Latin America and 40% in Africa. This integration creates additional revenue streams while enhancing customer engagement through comprehensive service delivery.

Buy Now Pay Later services, mobile banking, and payment processing create opportunities for telecommunications operators to participate in the growing fintech market. These services address customer needs while generating transaction-based revenue that complements connectivity services.

Implementation Strategies for Global Telcos

Localization and Market Adaptation

Successful super app development requires careful adaptation to local market conditions, cultural preferences, and regulatory environments. Global telecommunications operators must understand regional differences in consumer behavior, payment preferences, and service expectations to create relevant super app offerings.

The relevance of super app features must align with target audience needs and preferences. M-Pesa’s success in Kenya demonstrates how super apps can address specific market gaps through innovative service delivery that leverages local infrastructure limitations as opportunities.

Partnership and Ecosystem Development

Super app success often depends on strategic partnerships with local service providers, financial institutions, and technology companies. Telecommunications operators can accelerate super app development through collaborations that provide specialized expertise and market access.

Ecosystem development enables operators to offer comprehensive service portfolios without developing all capabilities internally. This approach reduces investment requirements while accelerating time-to-market for super app launches.

Regulatory and Competitive Considerations

Compliance and Risk Management

Super app development requires navigation of complex regulatory environments across multiple service categories including telecommunications, financial services, and data protection. Global operators must develop comprehensive compliance strategies that address diverse regulatory requirements while maintaining operational flexibility.

Data privacy and security become critical considerations as super apps handle sensitive personal and financial information. Operators must implement robust protection measures while ensuring compliance with evolving privacy regulations across different markets.

Competitive Differentiation

Super app markets often evolve toward oligopolistic structures where few platforms capture majority market share[. Telecommunications operators must develop distinctive value propositions that differentiate their super app offerings from existing competitors and technology platforms.

Network-based advantages including connectivity optimization, payment integration, and infrastructure control create opportunities for telecommunications operators to develop competitive super app offerings. These unique capabilities enable differentiated service delivery that competitors cannot easily replicate.

Asian super apps provide compelling evidence for the potential of integrated digital platforms to transform telecommunications business models while creating sustainable competitive advantages. Global operators can learn from Asian success stories to develop super app strategies that leverage their unique assets while addressing local market needs and regulatory requirements.

The transformation from connectivity provider to digital ecosystem orchestrator requires substantial investment, strategic partnerships, and cultural change within telecommunications organizations. However, the demonstrated success of Asian super apps and the substantial market opportunity justify the effort required for successful super app development. Operators that embrace this transformation position themselves advantageously for long-term growth in increasingly competitive and digitally-driven markets.