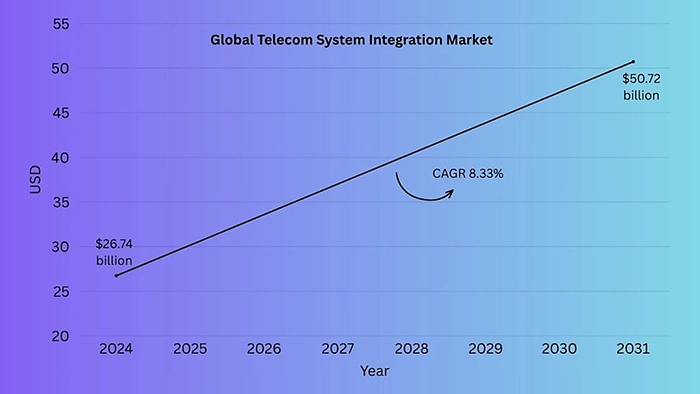

The global Telecom System Integration Market was valued at USD 26.74 Billion in 2024 and is expected to reach USD 50.72 Billion by 2032, expanding at a CAGR of 8.33% from 2026 to 2032. This market forms the technological foundation of modern telecommunications, providing the expertise and solutions required to unify diverse, complex systems into a cohesive operational framework. At its essence, telecom system integration focuses on connecting hardware, software, and networking components, including legacy systems, with cutting-edge technologies such as 5G, cloud computing, IoT, and AI. The goal is to build an integrated ecosystem that enhances performance, reliability, and scalability for telecom operators while simplifying operations and minimizing technological fragmentation.

The scope of this market covers several core service categories like Network Integration, Application Integration, and Cloud/Data Integration. Network Integration emphasizes optimizing network performance, particularly with 5G rollouts and the transition to software-defined networking (SDN) and network functions virtualization (NFV). Application Integration ensures seamless coordination between business and operational support systems such as OSS (Operation Support Systems) and BSS (Business Support Systems). Meanwhile, Cloud Integration supports telecom operators in migrating workloads to cloud environments, ensuring agility, scalability, and flexibility to meet future demand.

The rising complexity of telecom networks, driven by digital transformation and demand for high-speed connectivity, has positioned system integrators as essential partners in modern telecom infrastructure. They help operators merge technologies efficiently, maintain compatibility across old and new systems, and accelerate innovation cycles, all while enabling telecom companies to focus on their strategic growth areas.

Market Drivers

The Telecom System Integration Market is experiencing robust growth, largely fueled by advancements in next-generation connectivity and the global digital transformation wave. Several critical drivers underpin this market’s expansion, shaping the trajectory of telecom modernization worldwide.

The global deployment of 5G networks stands as the most defining catalyst for this market. Unlike previous generations, 5G introduces ultra-fast data speeds, extremely low latency, and the ability to connect millions of devices simultaneously. Integrating 5G into existing infrastructure, however, demands intricate coordination across multiple domains. Telecom system integrators play a pivotal role in harmonizing new Radio Access Networks (RAN), evolving core networks, and the broad portfolio of 5G-enabled services. Their expertise ensures that emerging applications, from smart cities and autonomous vehicles to industrial automation, can function efficiently within unified, secure ecosystems.

Telecom operators are rapidly transitioning their operations and IT systems to cloud environments, encompassing public, private, and hybrid models. This shift brings benefits such as cost efficiency, agility, and scalability. However, it also introduces complex integration challenges between traditional legacy systems and new cloud architectures. Telecom system integrators provide the critical bridge needed for secure interoperability, unified management, and seamless data flow. Their work ensures that operators can extract the full value of cloud adoption while minimizing service disruption during migration.

The explosive rise in connected devices and the growing adoption of IoT and edge computing further amplify the need for system integration. Billions of devices now generate vast amounts of data that require real-time processing close to the source. Edge computing enables this capability but only through robust integration. Integrators help manage these large data flows, reduce latency, and ensure interoperability between edge and cloud networks. They create the secure, scalable infrastructure necessary to support IoT growth, enabling real-time intelligence across industries.

Market Restraints

Despite its strong growth trajectory, the Telecom System Integration Market faces several constraints that impact large-scale implementation and adoption.

System integration projects are complex, resource-intensive, and time-consuming. They demand significant investments in new hardware, software licenses, and customization. Extended implementation timelines delay ROI realization and deter smaller telecom players with limited budgets, restricting wider adoption of advanced integration systems.

The challenge of merging modern technologies with legacy infrastructure remains one of the most significant bottlenecks. Many telecom operators still rely on decades-old systems that lack compatibility with modern, API-driven software. Integrating these outdated frameworks often causes performance issues and data misalignment, slowing modernization efforts and reducing network efficiency.

Another pressing challenge lies in the shortage of specialized talent. Managing large-scale system integration projects requires expertise in both traditional network architecture and emerging fields such as cloud, AI, and 5G. The lack of in-house knowledge compels companies to depend heavily on external consultants, raising costs and increasing dependency on third-party vendors.

As telecom networks become more interconnected, the risk of cyberattacks escalates. Each integration point represents a potential vulnerability. Legacy systems, in particular, often lack modern encryption and access control standards. This compels operators to allocate significant budgets for compliance and continuous monitoring to safeguard data integrity.

Integration initiatives often require fundamental operational changes across departments, leading to internal resistance. Employees may be reluctant to adapt to new tools or fear the loss of established roles, causing project delays. Successful integration depends as much on change management as on technical deployment.

Segmentation Analysis

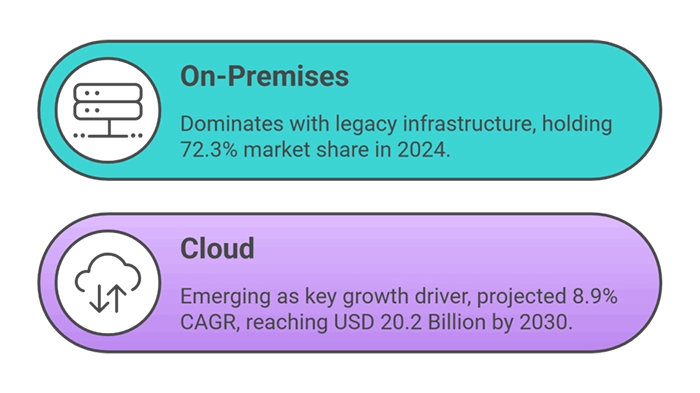

The Telecom System Integration Market is segmented into Cloud and On-Premises deployment types. The on-premises segment currently dominates, supported by the extensive legacy infrastructure of major Communication Service Providers (CSPs). In 2024, on-premises solutions accounted for roughly 72.3% of total market share. This dominance is particularly strong in regulated sectors such as defense, government, and banking, where data sovereignty and control are paramount. However, growth in this segment is moderate, projected at a CAGR of around 6.4% through 2030, due to high capital costs and lengthy implementation timelines.

Conversely, the Cloud segment is emerging as the market’s key growth driver. It is projected to achieve a CAGR of 8.9%, reaching approximately USD 20.2 Billion by 2030. Cloud adoption is propelled by the widespread rollout of 5G networks, NFV technologies, and digital transformation initiatives. Asia-Pacific leads this transition, with emerging telecom operators adopting cloud-native architectures to bypass legacy constraints and achieve faster scalability.

The market is further divided into Business Support Systems (BSS), Operation Support Systems (OSS), Network Management, and 5G Services (Adjacent Market). Among these, Network Management holds the largest share, approximately 37% in 2023, due to the growing complexity of network environments. The rapid deployment of 5G has intensified the demand for real-time monitoring, SDN, and NFV integration.

Operation Support Systems (OSS) form the second largest segment, enabling service assurance and fault management. Growth in OSS is accelerated by automation and AI-driven predictive maintenance, particularly in the Asia-Pacific region. Meanwhile, Business Support Systems (BSS) focus on customer-facing operations like billing and CRM, enabling flexible 5G monetization models. The 5G Services segment exhibits the highest potential, projected to expand at a CAGR exceeding 27% through 2033, driven by the adoption of Industry 4.0, smart cities, and connected healthcare solutions.

Regional Insights

North America, led by the United States, holds the largest market share. The region’s mature telecom infrastructure, early 5G deployment, and significant digital transformation investments position it as a global leader. High adoption of AI, IoT, and unified communication platforms further drive integration demand.

Europe is witnessing strong growth supported by regulatory frameworks like GDPR and ongoing digitalization efforts across EU nations. The continent’s emphasis on data privacy and operational automation, along with industrial IoT advancements in countries like Germany, underpins the need for robust system integration solutions.

Asia-Pacific is projected to be the fastest-growing region, driven by massive 5G rollouts, rapid urbanization, and government-led digital programs. Markets such as China, Japan, and South Korea are leading 5G integration, while India’s digital infrastructure initiatives continue to accelerate regional market expansion.

Regions including Latin America, the Middle East, and Africa (LAMEA) are in early stages of telecom modernization but offer immense growth potential. Significant investments in broadband and fiber networks, coupled with expanding cloud data centers, are driving demand for integrated, next-generation telecom systems.

Conclusion

The Telecom System Integration Market has become the cornerstone of the industry’s transformation, underpinning how modern communication networks evolve, scale, and sustain. As telecom operators worldwide accelerate the deployment of 5G, cloud-native infrastructure, and IoT ecosystems, the role of system integrators extends far beyond technical coordination—it now defines how value is created across the digital supply chain. These integrators are increasingly functioning as strategic partners, guiding operators through complex transitions that merge legacy frameworks with advanced digital architectures.

Despite persistent challenges, including high implementation costs, interoperability issues, and talent shortages, the market’s trajectory remains strongly positive. The convergence of automation, artificial intelligence, and edge computing is opening new frontiers for network optimization and service innovation. Telecom system integrators are also leading efforts in network virtualization and orchestration, ensuring flexibility and resilience across hybrid environments.

Looking ahead, integration capabilities will become even more critical as telecom operators navigate the demands of ultra-low latency, massive connectivity, and data-driven decision-making. The future of telecom will rely on seamless synchronization between hardware, software, and cloud platforms, a space where skilled integrators hold unmatched relevance. In essence, this market is not merely evolving with technology; it is defining the blueprint of the next-generation digital infrastructure that will support industries, economies, and connected societies worldwide.